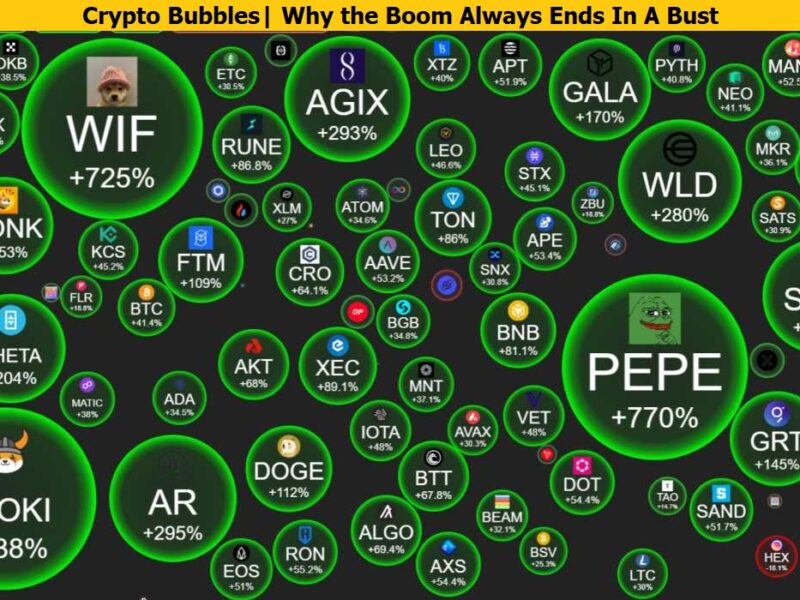

The rise of cryptocurrencies has been marked by spectacular gains—and rapid declines. These crypto bubbles capture headlines, attract FOMO‑driven investors, and then sometimes burst, wiping out fortunes overnight. As of 2025, with Bitcoin flirting with new highs and altcoins surging, it’s vital to understand:

- What defines a crypto bubble?

- Historical bubble cycles: from 2011’s hype to 2021’s peak and 2022’s crash.

- Key warning signs and psychology behind bubbles.

- 2025’s market: Is crypto in a bubble now?

- How to protect your investments when hype overtakes fundamentals.

What Is a Crypto Bubble?

A crypto bubble arises when asset prices—often speculative tokens—rise well beyond intrinsic value due to speculation, hype, and herd psychology. It follows a typical cycle:

- Innovation & Early Adoption: A new coin (like Bitcoin or NFTs) gains early traction.

- Media Hype & FOMO: Massive attention draws retail investors.

- Euphoria & Overvaluation: Prices spike on sentiment, not fundamentals.

- Burst & Correction: Sentiment changes, prices plummet.

Take the 2017 Bitcoin boom or 2022’s Terra‑Luna collapse—classic crypto bubble examples.

Historical Crypto Bubbles

Let’s review five major crypto bubbles:

| Year | Coin / Event | Characteristics |

| 2011 | Bitcoin’s first peak | Price soared from $0.30 to $32, then crashed. |

| 2013–14 | Bitcoin bubble around $1,200 | Sharp rise on news, crash to sub‑$200. |

| 2017 | Bitcoin & ICO mania | Bitcoin near $20K; altcoin and ICO hype. Burst into 2018. |

| 2020–22 | Covid rally and FTX/Terra collapse | Surge into 2021; Terra‑Luna implosion; FTX bankruptcy. |

| 2025? | Meme‑coin mania & institutional buzz | Bitcoin ~100‑k, Circle stock surging—bubble concerns rise. |

Each bubble reflects speculation exceeding real value, ending with sharp corrections.

Why Do Crypto Bubbles Happen?

Crypto markets are prone to bubbles due to:

- Speculation & “Greater Fool” mentality: Buying overpriced assets hoping to sell to someone else at a higher price.

- Media hype & social contagion: Influencers, news, and Twitter drives FOMO.

- Low liquidity & high volatility: Even modest capital flows can trigger large price swings.

- Leverage & margin trading: Amplifies both gains and losses, accelerating bubbles and crashes.

- Regulatory whispers: Rumors of bans or crackdowns can burst bubbles suddenly.

2025: Are We in a Crypto Bubble?

Is the market currently overvalued?

- Volatility remains high. Bitcoin and Ethereum both had sharp rallies and corrections in mid‑2025.

- Institutional euphoria: Bullish forecasts (e.g., Philippe Laffont predicting BTC cap doubling) coexist with hedge‑fund warnings (Elliott Management cautions of bubble risk).

- FOMOs & policy shifts: Recent US policy trends and celebrity‑driven memecoin hype raise bubble potential.

- Analysts disagree: some see sound fundamentals (payments adoption, de‑dollarization), others warn fundamentals aren’t keeping pace with price.

Bottom line: signs of a bubble exist, but timing a burst is nearly impossible. Often bubbles are obvious only after they pop.

Spotting a Crypto Bubble: Red Flags

- Extreme valuations: Prices far exceed historical norms or utility.

- Rapid price acceleration: Double‑digit gains in days without news.

- Surge in derivatives: Excessive margin/Futures use suggests speculative mania.

- Retail mania: Sudden influx of inexperienced investors—YouTube, TikTok, Reddit triggers.

- Decoupling from fundamentals: Projects with no use case exploding in value.

- Regulation chatter: Governments warning of instability or fraud.

Surviving Crypto Bubbles: A Survival Guide

When the air’s getting too hot:

- Stay diversified: Don’t bet your portfolio on a single token.

- Use cautious position sizing: Limit exposure to volatile plays.

- Set profit‑taking targets: Sell portions as price milestones hit.

- Avoid leverage: Margin can wipe you out when the bubble bursts.

- Use stop‑loss orders: Protect capital during sudden drops.

- Follow fundamentals: Prioritize tokens with real adoption and utility.

Bubble Psychology: When Logic Sleeps

Crypto bubbles are as much social phenomena as financial ones. The Greater Fool theory explains why people keep buying overpriced assets hoping someone else pays more. Yet, it’s always the last buyers who get “bag‑holders.”

Even historical geniuses weren’t immune: Isaac Newton infamously lost his fortune in the 1720 South Sea bubble. time.com

Bubble Impact: When the Tide Goes Out

A bubble burst can:

- Wipe out billions in market cap overnight.

- Trigger cascade failures: exchanges, DeFi protocols, and related firms may collapse.

- Invite regulation: governments tighten rules post‑crash to protect unsophisticated investors.

- Purge weak projects: only lasting protocols with real use cases survive.

Lessons from Past Crypto Bubbles

- 2017–18: Evaluate coins’ fundamentals, not just hype.

- 2020–22: Leverage and stablecoin collapse (Terra‑Luna) showed systemic risk.

- Post‑2022: Exchanges and projects tightened compliance; investors emphasized due diligence.

Is 2025 a Bubble? Investors Beware—but Stay Grounded

2025’s bullish narratives—Bitcoin crossing $100K, large capital inflows—coexist with historical red flags: rising leverage, celebrity hype, policy shifts. Whether crypto is in a bubble remains debated:

- Optimists: point to institutional adoption and Bitcoin’s digital‑gold narrative.

- Skeptics: warn valuations exceed utility, and volatility remains high.

Prudent investors treat the run‑up as cautionary, balancing potential upside with systemic risks.

Crypto bubbles represent the cyclical mania in digital‑asset markets: exuberance driven by speculation, hype, and psychology. History from 2011 through 2022 shows repeated boom‑and‑bust cycles, and signals point to continued risk in 2025.

Key takeaways:

- Understand bubble dynamics and spot warning signs early.

- Prioritize fundamentals and risk management over hype.

- Use disciplined strategies: diversification, profit‑taking, stops.

By recognizing that crypto bubbles are part of the market’s DNA—and preparing accordingly—you can safeguard your investments, capitalize on opportunities, and avoid being swept away when the bubble inevitably bursts.